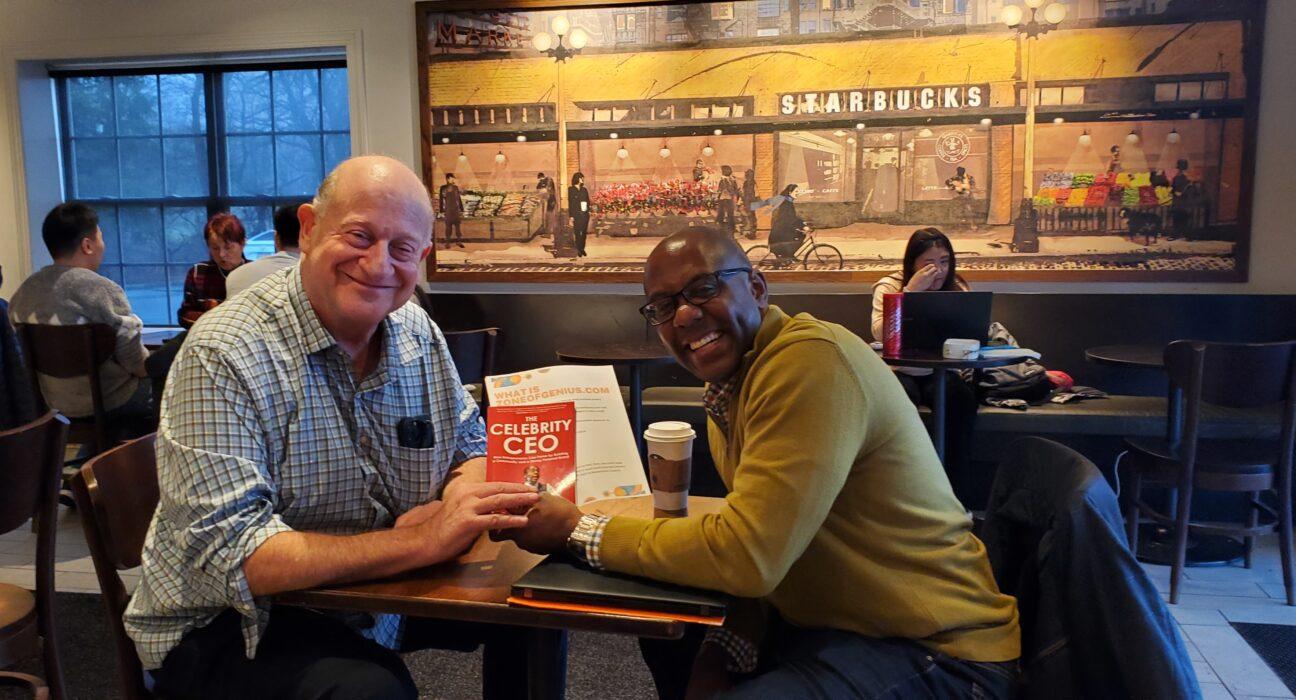

Recently I had the opportunity to sit with an investor to pitch him to invest in my business. The meeting went very well, but in a way you might not expect. It’s one thing to write about entrepreneurship and speak about it, as I do, it’s quite another to site across the table from an investor and make a pitch for your own business.

Relationships Are Important

Absolutely there’s many times where an investor is pitched by someone she doesn’t know, or who is pitched at a pitch contest or some other means.

However, nothing beats having a conversation with someone who you have been referred to. The “transfer of trust” is a real thing. Venture investing is for sure about the BUSINESS itself but a large part of it is also about the founder who has the business and wants funding.

I was introduced to this investor by a mutual friend. In fact, he’s the brother of the person who brought us together.

So I believe the trust was established, this was not a “cold pitch” to a complete stranger.

Does Your Business Have any Revenue?

No matter what all the details are in your business plan. No matter how well written it is or how fancy the graphics are. Having sales is one of the best ways to warm up an investor.

Without sales, the investor is judging on the idea, on maybe your past track record, any special and defensible intellectual property you have.

However, when you have sales, even just a little bit, you’re well on your way to showing to the investor (and to yourself) the viability of your idea.

I was pitching for investment in ZoneofGenius.com, to give us additional funding to hire writers and a business development person and a few other roles, to help us grow faster. However, we are not generating any “meaningful” revenue.

Sure, I’ve started 5 companies and sold three of them and I’m generating revenue OVERALL, but not directly from ZoneofGenius.com – YET. We’re a startup.

The investor challenged me to first generate revenue, even just $50,000 directly from ZoneofGenius.com, before seeking his investment.

[Side note: How does a media company make money? A company like ZoneofGenius.com, Inc.com, The Hustle, Morning Brew, Entrepreneur.com or other similar companies? Media companies make money from sponsor revenue through sponsored content, events, sponsored webinars and etc]

What Does an Investor Want?

No matter how nice an investor is, and my investor is VERY nice, investing is a business.

You go to the store, pay money and get a bag of grapes or a Snicker Bar. You get something for your money.

Well, an investor is the same.

She “gives you her money” (called an investment) and in return she wants to get back MORE money that she gave you, based on the growth of your business.

It’s a VERY risky bet. Most investments fail and don’t work out.

Most investors want a 10x return on their investment. If they’re investing $300,000 in your business, they want to earn back, around $3 million from that investment.

Remember, the investor could have invested 5 or 7 other times. And lost all of his money.

He’s betting on 1 out of a few investments doing very well, to make up for the losses of the other investments.

There are several ways you can fund the growth of your business.

- Credit cards

- Bank loan

- Bank line of credit

- Invoice financing

- Friends and family

Whichever route you choose you’re going to “pay for the money” you received in one way or another. An investor is no different.

I was thinking to grow ZoneofGenius.com to a low million-dollar business. However, If I get an investors money, I might not be growing the business enough to give the investor back the return they want and get the return on the investment that I want.

Is Ramon Thinking Big Enough

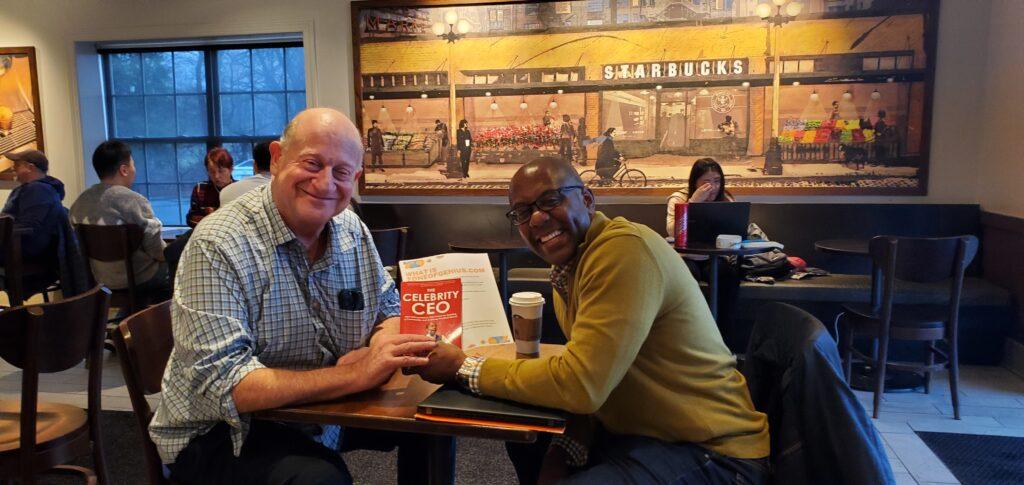

During our conversation, I was challenged (in a good way) multiple times by this investor.

He said Ramon, “are you thinking big enough”.

Sure, it’s my choice if I want to grow my business to $5 million or $500 million. However, I’ve been thinking. Maybe I am thinking too small.

Sure MOST companies are not at $1 million or above in revenue. That in itself is an extraordinary feat to grow a business over $1 million in revenue.

However, should I be thinking of building a $10 million or $50 million business? Lots to think about.

The size of the business I grow will impact the lifestyle I want to live, the time I commit to it and more.

The Conclusion

The proverbial ball is in my court.

If the conversation was a score board here’s how I’d score it, not sure if the investor would agree, but here’s MY score, with 10 being the highest.

Personal trust and relationship: 10

Viability of business: 8

Marketplace proof of idea: 7

Is it big enough for an investor: 6

Related articles

How To Hire a PR Firm To Get Publicity for Your Business(Opens in a new browser tab)

Why Selling Your Business Is a Good Thing – Understanding the Benefits(Opens in a new browser tab)

Here’s How to Write Your Business’s First Business Plan(Opens in a new browser tab)

Is The Wrong Money Mindset Holding Back Your Business? 5 Power Tips.(Opens in a new browser tab)

Are You Ready for Investors? Be Careful What You Ask For.(Opens in a new browser tab)