“The one thing I tell everybody is that if it’s too good to be true, it has some element of scam in it, and that’s really always the case,” says Lemberger.

The digital age has brought tremendous opportunities for small businesses to grow and reach new customers online. But it has also opened the door to a surge in fraud and scams that business owners need to protect against. In a recent interview, Mike Lemberger, Regional Risk Officer for North America at Visa, discussed the current fraud landscape and ways small businesses can stay safe.

Watch the entire episode on YouTube or listen to our podcast.

The Growing Threat of Scams and Fraud

Visa, a leading tech provider and financial network, is deeply invested in ensuring the security of money transfers. As Mike explains, Visa’s brand is built on trust and security. With the rise of digital transactions, protecting consumers’ and businesses’ financial data has become paramount.

The Evolution of Fraud

With advancements in technology, fraud has evolved. Traditional methods like pickpocketing have given way to sophisticated digital scams. Fraudsters are now exploiting online platforms to steal money and data. Mike highlights that as security measures improve, fraudsters adapt, finding new channels to exploit.

Common Scams and How to Avoid Them

Mike describes the inundation of scams through texts, calls, and emails. Fraudsters are becoming increasingly creative, leveraging technologies like AI and deep fakes. He emphasizes the importance of being cautious and skeptical, especially when offers seem too good to be true.

Triangulation Fraud

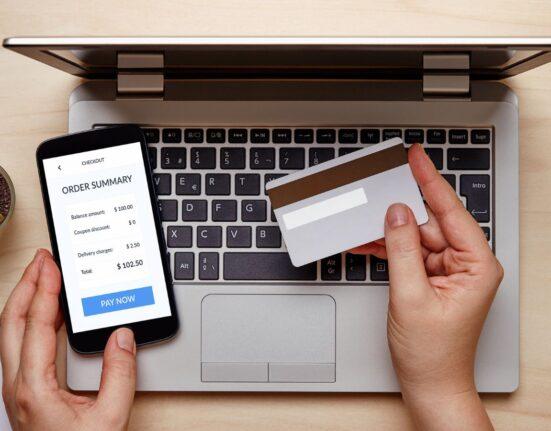

Mike introduces the concept of triangulation fraud through a compelling example. A consumer sees an ad for a heavily discounted smartphone, makes the purchase, and receives a legitimate product. However, behind the scenes, the fraudster uses stolen card information to buy the phone from a legitimate retailer and pockets the difference. This complex scam highlights the need for vigilance and skepticism.

Tips To Avoid Frauds and Scams

1. Fortify Your Business. Mike advises business owners to be cautious and validate their business entities. It is crucial to use reliable partners and ensure transactions are secure. He suggests leveraging financial institutions and trusted networks to validate transactions.

2. Embrace Tokenization Tokenization is a crucial security measure Visa employs to protect transaction data. By encrypting card information, tokenization ensures that sensitive data is not exposed. This reduces fraud and increases transaction security. Mike mentions that over 50% of online transactions are now tokenized to reach 100%.

3. Implement Multi-Factor Authentication. While security measures like thumbprints and two-factor authentication (2FA) may seem cumbersome, they protect your business. These layers of security help prevent unauthorized access and ensure that transactions are legitimate.

Protecting Your Online Presence

Protecting your online and offline business operations is more crucial than ever. Whether in omnichannel security or influencer marketing, ensuring robust protection against cyber threats is essential to maintaining trust and operational integrity

Omnichannel Security

For businesses operating both online and offline, maintaining consistent security across all channels is critical. Mike advises ensuring that descriptions and processes are consistent to avoid vulnerabilities. Fraudsters often exploit inconsistencies between in-store and online operations.

Influencer Marketing and Small Business

Influencers and online creators are becoming small businesses themselves. Mike warns them to be cautious about the platforms they use to collect payments and manage transactions. Ensuring that these platforms have robust security measures is vital to protecting their income and reputation.

Steps to Take If You’re Hacked

1. Immediate Actions. If your business is hacked, the first step is to limit the damage. Notify your financial institution or payment facilitator immediately. These partners have the tools and expertise to help mitigate the impact and protect your business.

2. Report to Authorities. Mike advises reporting breaches to law enforcement agencies like the FBI or Secret Service through their official portals. This helps track and prevent further fraudulent activities.

3. Check Your Credit. For both consumers and businesses, regularly checking credit reports is a good practice. This ensures that any unauthorized activity is detected early and addressed promptly.

Final Thoughts

The conversation between Ramon Ray and Mike Lemberger underscores the importance of proactive measures in protecting your business from frauds and scams. As fraudsters become more sophisticated, companies must stay informed and leverage the right tools and partnerships to protect their operations.

Visa’s commitment to security, through innovations like tokenization and robust risk management, provides a strong foundation for protecting financial transactions. By staying aware and implementing recommended practices, businesses can navigate the digital landscape securely.

Protect your business by staying informed, using secure transaction methods, and partnering with trusted institutions like Visa. Remember, if it seems too good to be true, it probably is. Stay safe and secure in your business endeavors.

Read more: How to Pay Global Customers and Not Be Scammed by Online Money Transfers