Outline: Hard Questions | New Possibilities | Creating a Passive Income | Passive Income Vehicle | How to Choose | Final Thoughts on Passivepreneurs

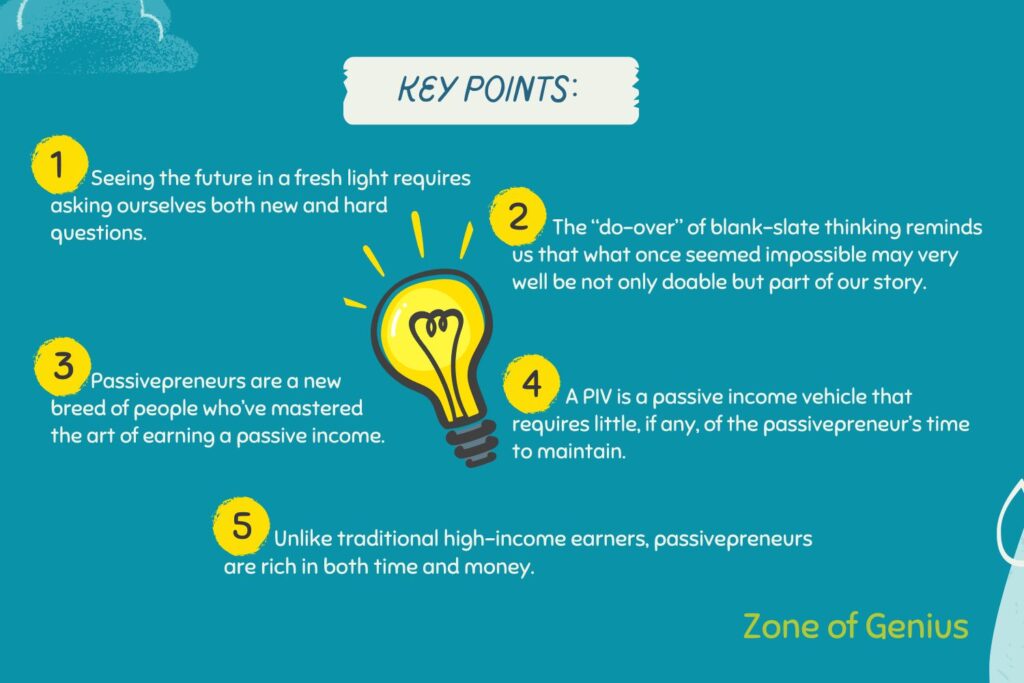

When was the last time you felt burned out or worked until you nearly dropped? Could there be a better way to build wealth that doesn’t cost your health, relationships, or decades of slaving away in a job you hate? In Don’t Start a Side Hustle, Brian Page reveals the passivepreneur — a new kind of wealth builder paving the way for a life rich in time and money.

The Hard Questions are Underrated

Imagine if you had back every single minute you’ve ever spent working. Add in every overtime hour you’ve ever worked. Now add in every decade you’ve invested in your career.

If you had that time back right now to do with as you please, how would you spend it? Would you change anything? What if we took that question and applied it to the future? If you had every minute from today until the end of your life to spend as you choose, what would you do?

Giving ourselves a “do-over” allows us to ask hard questions like:

- Would I choose this job or career again?

- Would I finally do what I’ve always dreamt of doing with my life?

- Would I only spend time in pursuit of what I’m passionate about?

- Would I spend more time in the company of those I love?

- What if work was not a top consideration?

This may seem like an unrealistic thought experiment but stay with me. New ways of seeing the world only emerge by asking ourselves new questions. As Tony Robbins says, “The quality of your life is directly proportional to the quality of questions you ask.”

Let’s Bring on New Possibilities

New questions may feel uncomfortable. They may even, on the surface, appear unrealistic because they are so novel. Often our brain immediately thinks that it’s not possible.

“Brian, I work a full-time job. I’m a parent and a spouse; I have responsibilities and I have no time as it is now.”

“I make enough to cover my bills, I maybe even have some money left over. But I could hardly choose to stop working. I need my job.”

There is a reason we must ask ourselves new questions. It’s only with “blank-slate thinking” that we can craft our lives to be magical. New possibilities can emerge from at least considering what may right now seem impossible.

The Art of Creating a Passive Income

There is a new class of wealthy people emerging today, called passivepreneurs. They are financially well-to-do (think money/income/assets). But they’re also rich in discretionary time. Their lifestyle allows them to be anywhere on the globe they like. They can be with whomever they want to bring along for the ride and stay for as long as they want to be there.

Passivepreneurs are not:

- traditional high-income earners like surgeons or attorneys

- titans of business who run billion-dollar companies

- founders of tech startups in Silicon Valley

- workers on Wall Street

- trust-fund kids who were born into money

Passivepreneurs come from diverse backgrounds and education levels. They look very different from each other. But the one thing passivepreneurs have in common is that they have mastered the art of creating passive income. They live a life of unlimited time, ultimate choice, and true financial freedom.

In this book, we will profile many of these individuals. We’ll also explain how they differ from the run-of-the-mill “money rich.”

PIV (Passive Income Vehicle): The Gift That Keeps on Giving

Focusing solely on increasing the digits in your bank account is a recipe for disaster. Why? Because money is but one factor in measuring what it is to be rich. Becoming a passivepreneur is not only possible but can happen in considerably less time than you may think.

The first thing you will learn about passivepreneurs is that they all have a financial source from which they can draw. This source is not earned income, and it is never a job.

A passivepreneurs’ passive income vehicle (or PIV, as we will refer to it in this book) requires little, if any, of their direct time to maintain. Their financial source is independent of them. Regardless of what they do, their PIV feeds them day in and day out. They do not live to work; their PIVs do that for them.

Time for a Change

The highest priority of a passivepreneur is not to hit some arbitrary dollar amount in the bank, like a million dollars. They aren’t chasing a higher salary or a vague idea of “more” money. In fact, money is so little of a concern for them that they don’t think about it much. They are too busy enjoying life.

Passivepreneurs have built reliable and redundant sources of cash flow. These PIVs allow them to have a very different relationship with money. Unlike those with high net worth but are time bankrupt, they have the time to create a life they love.

What would you do if you were time rich? What kind of possibilities would be open to you?

- Would you go on a three-month tour of Europe and then jump to another continent for the next three?

- Would you join a martial arts class to get your black belt?

- Would you become an actor at the local theater or pursue becoming a master musician?

- Would you stay home with the kids when they’re young?

- Would you go into full-time unpaid ministry, become a missionary, or start a nonprofit?

- Would you hike the length of the Appalachian Trail without a cell phone?

- Would you spend your days anchored in the stunning Charleston harbor while you write your first book, as I’m doing right now?

Think about what life would be like if you no longer had to think about needing to work for money. Can you imagine a life where weekends were no more exciting than weekdays because every day of the week was yours? What about a life where no one tells you where you have to be or how long you can be gone?

Any of this and more will be open to you when you become a passivepreneur.

Choosing Your Passive Income Vehicle

You’ll never be at a loss for passive income vehicles if you know where to look. Let’s go over a few here so we can narrow the list to one that we can launch in the next thirty days.

1. Sponsorships and Endorsements

Sponsorship occurs when you have an audience of a certain size, like an email list or follower count on social media. An advertiser may offer to pay you to promote their products. You give a recommendation for the product or service in exchange for payment. It’s the perfect example of working once and getting paid many times.

The only caveat here is that you need to be careful to only sponsor companies related to what you’re about. If the offer aligns with your values and audience, it can be a very good PIV.

2. Templates, Spreadsheets, and Checklists

You might be surprised to learn that you can create simple tools in Google Sheets for zero dollars and sell them online to consumers. The key to selling these kinds of tools is to provide a solution to the buyer that makes getting the result they’re after quicker or easier.

3. Digital Interactive Tools and Calculators

One of the products that I sell is the BNB Deal Analyzer. Essentially, it’s a glorified calculator that allows people to figure out what they will make on an Airbnb listing after all expenses. When I first launched my Airbnb business, I had a hard time figuring out how to forecast what I would make on a property. There were so many variables that went into the equation. If you didn’t calculate one correctly, you had to start all over again.

So I hired a software engineer to develop a simple-to-read dashboard with easy-to-use dials. It cost me about $1,200, and it took several months to get it right. But when done, there was nothing else like it available anywhere. I immediately went out to sell this product to people in the Airbnb space.

To this day, that product has passively generated multiple six figures in sales. And the most important thing? Since I created it two years ago, I have put zero time into managing that PIV. Not one minute.

I’ve seen calculators for stock trading, flipping houses, commercial real estate analysis, and managing diet regimens. The sky’s the limit for creating one of these cash cows.

4. Scalable Services

This category of income-producing assets is anything that can be delivered to the consumer that isn’t a physical or digital product. The key distinction here is that it can’t be a one-to-one service. The opposite of this would be selling a service that is scalable.

Find a service that is scalable and not dependent on you to manage and put that PIV in your corner. For example, one of my friends has a virtual assistant (VA) company. My friend can get an unlimited number of VAs overseas and mark up their labor to sell to the end user. Since he has somebody who manages all of these VAs, not only is he able to scale, but he can do it without any direct intervention.

5. Digital Courses

I have a special place in my heart for digital courses. To this day, they remain one of my most consistent PIVs and can be structured to be completely hands-off if done correctly. Online courses are all about selling information.

In my opinion, that is the best product you can sell. It doesn’t require inventory or packaging. You don’t have to ship it anywhere. Your customer gets it instantly after they purchase and it can sell for 100 percent on autopilot.

6. Stocks

Some companies distribute a part of their profits to all the shareholders. This is one of the easiest passive income sources available. Once you buy the dividend-paying stock, there’s nothing else to be done. These dividends continue to roll in and can be leveraged back into more stock purchases or withdrawn as income. You can pick stocks individually or even invest in dividend-paying funds, which are essentially a group of stocks.

7. White Label Products

White labeling is a great way to control assets. Not only can you create your brand by reselling a manufacturer’s product in your packaging, but you can also use drop shipping. This method of controlling assets is where items purchased by the end user are shipped directly from the manufacturer. You have no need for warehouses, no shipping centers, and no employees. It’s all done for you. You control the marketing and sale of the product, and a third-party drop shipper takes care of the rest. You’d be surprised how many brands are white-labeling products they didn’t create—and there’s no reason you can’t do the same.

8. Embedded Offers

Embedded offers are when a product or service is within another product or service already purchased by the user. For example, when you buy an iPhone and go to the App Store, every time you click on an app and buy something, Apple gets half of that fee. The app is embedded in the iPhone, which is the product the user paid for.

The easiest way to find great embedded offers is to ask yourself: What do my buyers need next? If it’s not something that you sell yourself, find somebody that does and make a deal with them.

Final Thoughts

There are more PIVs available today for passivepreneurs than ever before. Check the appendix at the end of the book for a big list. If you want access to even more resources, training, and passive income vehicles I recommend, please visit www.dontstartasidehustle.com/resources.

Related:

How To Create Your First Online Course And Make Money While You Sleep

How Anyone Can Create an Online Course or Coaching Business and Make Money Doing What They Love

About the Author:

Brian Page is an author and speaker focused on passive income creation. He has worked with such heavyweights as Grant Cardone, Tai Lopez, Dean Graziosi, and Kevin Harington from Shark Tank and has been featured in Entrepreneur, Inc., MSNBC, and Forbes. Page is best known as the creator of the BNB Formula, the world’s #1 bestselling Airbnb™ coaching program with over 25,000 students in 47 countries. He is the host of the “Digital Titans Podcast” and the star of the reality show “House Hackers.” His current Passive Income Vehicles™ include digital products, short-term rentals, online coaching, affiliate offers, commercial real estate, mortgage notes, dividend stocks, and cryptocurrency staking, to name a few. Page’s latest book, “Don’t Start a Side Hustle!” will be released Nov. 8, 2022, via HarperCollins Leadership.