Avalara, Inc. a provider of cloud-based tax compliance automation for businesses, announced the release of released a survey of 500 Main Street accountants representing more than 100,000 small businesses.

Survey responses revealed that looming economic headwinds may create challenges for small businesses in the next 12–18 months.

Small business clients may face difficulty accessing fresh capital, increasing profits, managing payroll costs, weathering supply chain difficulties and hiring new staff. Accountants were more positive about the ability of small business clients to adopt new technology and automation.

Accountants reacted with concern and caution to current economic indicators for the national economy in the next 12–18 months.

Digging deeper into key drivers of growth and profitability, the survey looked at how economic conditions will affect the ability of small businesses to:

Access to Capital

According to the survey, 72% of accountants projected that their small business clients would experience more difficulty accessing fresh capital over the next 12-18 months. This may make it more challenging for small businesses to invest in their infrastructure or expand services in new markets. Furthermore, due to the current economic situation, investors may be more cautious in lending money to small firms. However, some fintech companies offer alternative financing options to small business owners, such as invoice financing and revenue-based financing. Entrepreneurs must explore these alternatives to keep the cash flowing.

Revenue Growth and Profitability

Nearly half of the accountants surveyed (49%) expected their clients to face more obstacles in raising revenue, making it difficult for small businesses to break even and grow. Furthermore, 61% of Main Street firms surmise that their clients’ ability to increase profits will be “much” or “somewhat worse.” A decline in sales can have significant implications for a small business, leading to layoffs and reduced expansion plans. To keep their companies financially stable, small business owners must be proactive in streamlining their operations and finding new revenue channels.

Managing Payroll Costs

The survey discovered that 63% of accountants predicted that small businesses would struggle more with managing payroll costs in the next 12-18 months. Small business owners must look into solutions like teleworking, reducing work hours and pay cuts, and eliminating fringe benefits, such as employee health insurance premiums. Employers may also consider offering a reduced workweek schedule or flexible work arrangements, such as shared jobs or job sharing.

Related: Simple Money Tips for New Business Owners

Hiring New Employees

The survey also revealed that 60% of firms surveyed believe that small businesses will have a more difficult time hiring new employees in the coming months. Hiring is critical to small business success, but the uncertainty of pandemic recovery and changing economic conditions could make it harder for entrepreneurs to retain or attract top talent. Entrepreneurs must explore innovative solutions like virtual work environments, decentralizing the business model, and creative incentives to build and maintain a skilled workforce.

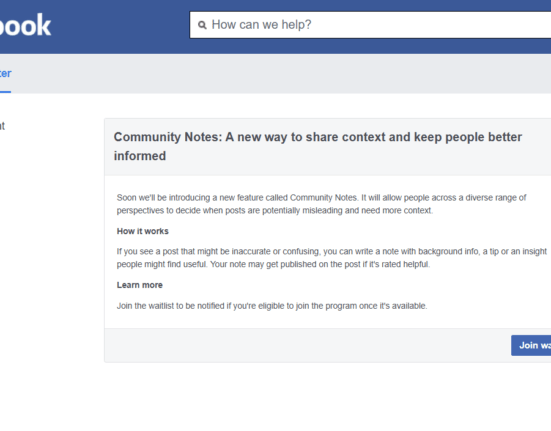

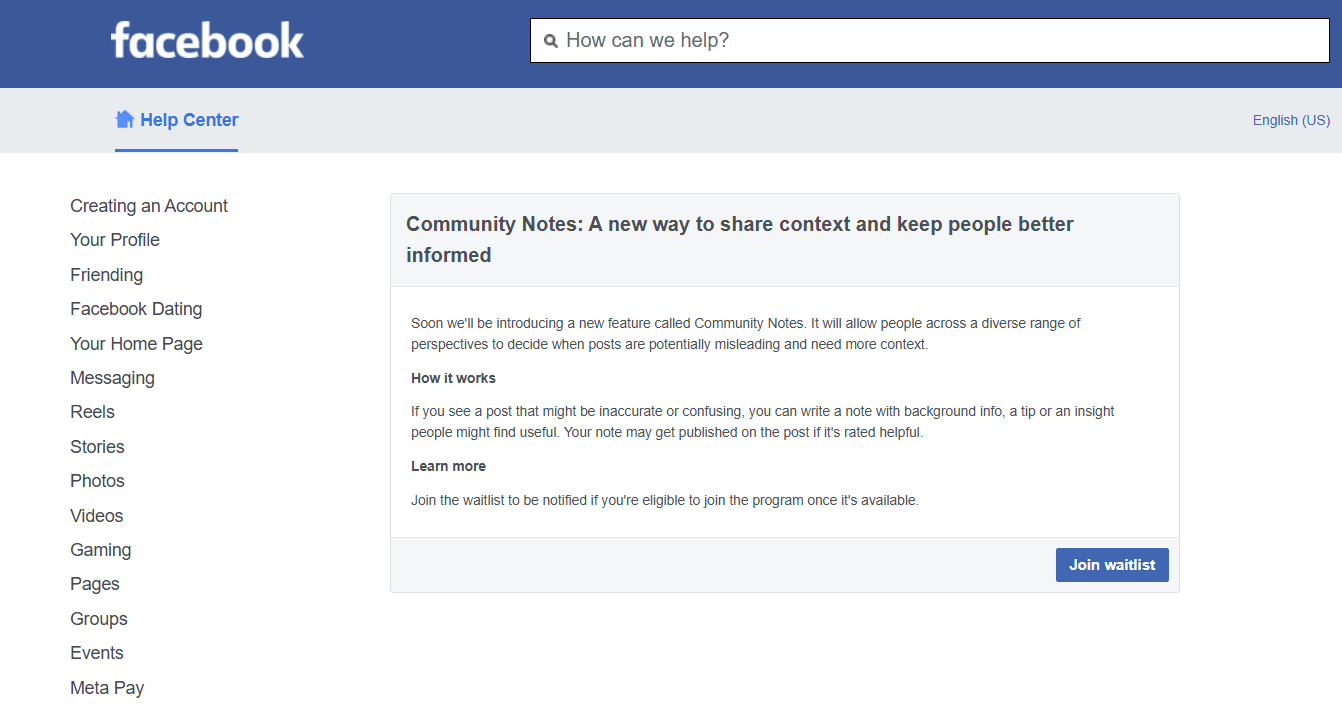

Technology Adoption

At a time when technology adoption is more important than ever, the survey discovered that 70% of accountants responded positively to the ability of small business clients to adopt new technology and automation. It’s essential for small businesses to leverage technology to streamline processes and increase efficiencies in operational arrangements. The right technology can help business owners reduce their costs, optimize processes, and manage data better.

What’s the advice of accountants to their clients?

Hang on to Cash and Stay on Top of A/R

It’s time to dust off those old cash flow management and budgeting plans and pay close attention to your accounts receivable (A/R). Ensure that your customers are paying you promptly. Identify any revenue shortfalls so that you can concentrate on the cash needed to keep your business moving forward.

A/R management should become your priority. Stay in touch with your clients and encourage prompt payments without alienating them. Remember to work with customers to find a payment plan suitable to both parties.

Utilize Technology Where Possible

Consider moving to online invoicing, electronic payments, or cloud-based accounting software. Online tools and software solutions facilitate better record-keeping and provide more accurate data in real-time. Not only do they enable timely reconciliation of accounts, but they also aid in precise forecasting of future revenues.

The benefits of using technology also include the ability to detect any errors or discrepancies in accounts, allowing room for corrections and better accuracy.

Add Overhead Costs Only if Assured That the Associated Revenue Is Not Transitory

In times of financial uncertainty, business owners must focus on conserving funds. Adding overhead expenses should only be done if assured that the associated revenue is stable and not dependent on external circumstances like government aid or grants.

Review and streamline your existing expenses and cut out any non-essential expenses. Prioritize business expenses like salaries, rent/mortgage, and utilities. To avoid any unforeseen expenses, it is advisable to have a conservative budget until there is more certainty in the business environment.

Stay Liquid, Reduce Loan Payments

Reduce your loan payments if possible. The extension of the loan payment term, interest rate renegotiation, or deferment of payment can contribute to better liquidity. The goal is to free up cash, prolong payments, and keep the business running until stability returns in the business environment.

Stay informed about the government’s economic policies and financial aid programs for small businesses. Evaluate your eligibility to procure any aid or grants available, if any. Remember, these are challenging times, and you must be proactive in seeking financial solutions.

Related: How to Future Proof Your Business

Be Nimble to Respond to Changes, Take Care of Your Good Employees

As the economic crisis continues, it will be necessary to be agile and responsive to keep up with the changing market conditions. Pay attention to customer demand and emerging trends in technology and business models.

Take care of your good employees. Offer support, reassurance, and guidance. It’s difficult to find new people, and it’s expensive, so don’t let morale or productivity suffer.

Cash Is King. Do Not Be Afraid to Increase Fees

It may be time to consider increasing your fees to stay cash-positive. Do a cost-benefit analysis of your services, and identify areas where you can realistically raise charges. Speak to your clients and give them valid reasons for the fee hike.

Ensure that the increase in fees is in line with market rates and does not hurt your competitiveness.

Related: 4 Reasons to Raise Your Prices

Line Up Any Capital or Loans Needed ASAP

Ideally, businesses should have adequate cash reserves for a minimum of three months’ operating expenses. However, this may not always be possible, so line up any capital or loans needed as soon as possible. Remember, the sooner you can address any cash flow challenges, the better.

Small businesses face a difficult challenge, navigating the economic uncertainty in a post-pandemic world. While there is no one response that suits all, it is essential to focus on conserving cash flow, seeking government aid/grants where possible, and maintaining agility and flexibility to keep up with changes in the market.

Follow the advice of the accountants we have highlighted, prioritize A/R management, streamline expenses, and invest in the necessary technology to support your business.

Small businesses are the backbone of the local economy. Unfortunately, the survey in question reveals that small business owners may face more challenges with accessing capital, raising revenues, managing payroll costs, and hiring new employees in the next 12-18 months. However, small business owners can remain resilient in the face of these obstacles by streamlining operations, exploring alternative financing options, leveraging technology and automation, and focusing on new revenue opportunities. Overall, by adopting a proactive and innovative mindset can help small businesses weather the challenges of today’s economic environment. Remember, it’s okay to seek help when you need it – better to be proactive than reactive!

Related articles: