The debate between using debt for business expansion and strictly shunning it has been long-standing and heated. As business owners, we stand at a crossroads where financial decisions can pivot the trajectory of our endeavors.

Each move we make, laden with either debt or discipline, dictates the path of our company’s growth. But what’s the right move? In this post, we will explore what debt is, good and bad debt, and find the true essence of debt and leverage.

What Is Debt?

Debt is money borrowed by one party from another under the condition that it’s to be repaid, often with interest. It can take many forms, from loans and credit lines to bonds and mortgages.

It is not merely a financial obligation but also a tool that, when used wisely, can catalyze growth and facilitate investment opportunities that otherwise wouldn’t be possible.

Through leveraging, companies can amplify their purchasing power to acquire assets, expand operations, and increase their market presence. This strategic approach to debt can lead to economies of scale and potentially higher returns on investment as long as the profits ultimately generated exceed the cost of borrowing.

Read: 3 Ways to Build a Sustainable and Profitable Business

Good Debt vs Bad Debt

Good debt is often characterized as an investment that will grow in value or generate long-term income, such as taking on a mortgage for a property that appreciates or a business loan for expansion that boosts revenue.

For instance, a small but thriving boutique café takes out a loan to fund a second location in a high-traffic area. The owner, having done extensive market research, predicts that the new location will double its revenue within a year. This strategic use of debt uses leverage to expand the business and increase income. It exemplifies a calculated risk that has the potential to yield significant financial growth.

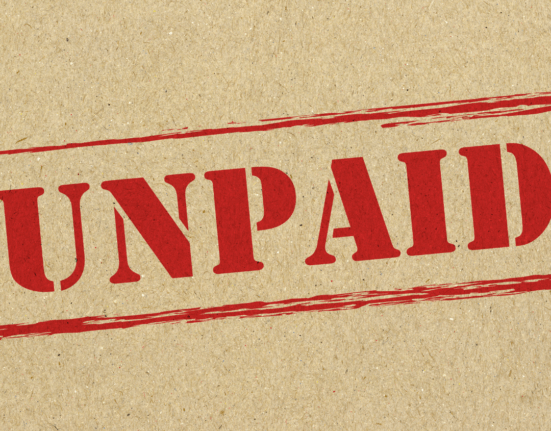

In contrast, bad debt is borrowing to purchase depreciating assets or for non-essential expenditures that do not contribute to financial growth or create income, like using a credit card for luxury items that one cannot afford. Understanding the distinction and applying it to business practices can be instrumental in pursuing sustainable growth.

On the flip side, consider a retail store that takes out a loan to finance an extravagant ad campaign for a new product line without thorough market testing. The debt incurred is anchored on the hope of increased sales.

However, if the campaign fails to resonate with the target audience, the store is left grappling with the dual blow of unsold inventory and a debt that does not self-liquidate. This type of borrowing represents bad debt. The cost of the loan surpasses the benefits, and the investment fails to produce the income necessary to justify or repay the debt.

Debt & Leverage: Dave Ramsey vs. Grant Cardone

Debt leverage is using borrowed capital, or debt, to increase the potential return on investment. In the business context, companies leverage debt as a means to invest in business ventures, expand their operations, and boost profitability.

Essentially, it is the act of using debt to invest in growth opportunities rather than solely relying on retained earnings. The concept rides on the principle that if the return on the leveraged assets exceeds the cost of the debt, then the excess returns will benefit the company’s shareholders.

This strategy, however, carries risks, as an over-leveraged company might face financial difficulties if its investments do not yield the expected returns or if market conditions deteriorate.

Dave Ramsey’s Stance: The Zero-Tolerance Policy

Dave Ramsey’s philosophy on business borrowing resonates with caution and a zero-tolerance policy towards debt. His advice often sounds too rigid for the entrepreneur who is taught to hustle and leverage.

Ramsey’s convictions rest on the stance that debt—no matter how strategic it might seem—poses an inherent risk that can tie down a business rather than propel it forward.

Dave Ramsey advocates for a conservative approach, where businesses are encouraged to grow organically, using earnings rather than borrowed capital. He shares that debt magnifies risk rapidly; a downturn in business can transform manageable payments into insurmountable liabilities.

Emphasizing the merit of patience over the instant gratification of rapid growth, Ramsey’s zero-tolerance policy implies that operating within one’s means establishes a stronger, more stable foundation.

His philosophy is built on the notion that debt-free operations prevent the added pressure of external repayments and interest, allowing business owners to make decisions that are not influenced by the burden of debt repayment schedules.

Grant Cardone’s Approach: Leveraging Debt

On the flip side, Grant Cardone preaches the gospel of leverage—asserting that calculated debt is not only beneficial but crucial for fast business growth. This perspective hinges on the belief that access to capital, even through borrowing, can unlock opportunities otherwise out of reach, driving aggressive expansion and profitability.

Grant Cardone’s methodology revolves around scaling businesses quickly and asserts that leveraging debt can exponentially increase one’s ability to generate wealth. He argues that the use of debt can powerfully propel business growth if handled with discipline and foresight.

In Cardone’s view, debt becomes an integral part of a strategic investment plan, where leveraging amplifies potential rewards that far outweigh the risks.

His strategies are tailored for those who have a thorough understanding of their business model and market conditions and who are willing to strategically embrace financial leverage to outpace competitors and seize market share.

As controversial as it may be for risk-averse individuals, the Cardone approach reflects a bold and proactive approach to business financing that can lead to phenomenal success when executed correctly.

The Debt-To-Profit Ratio: Navigating the Dynamics

The pivotal factor in this equation is understanding the debt-to-profit ratio. This metric measures the return on every dollar borrowed against the cost. A healthy ratio ensures that the leverage is indeed elevating the company, not anchoring it to the ocean floor.

A favorable debt-to-profit ratio indicates that the company is generating adequate income to cover its debts while still securing a profit.

Conversely, a poor ratio could suggest that the company’s borrowing is not sufficiently translating into financial gain, potentially signaling a need to reassess its leverage strategy.

Why Ramsey’s Cautious Approach Holds Weight

Reflecting on past missteps, Dave Ramsey’s cautious approach begins to take on a form of wisdom. The debt-to-profit ratio cannot be ignored if one seeks to use debt effectively. The value of Ramson’s advice can be felt by businesses that have experienced fallout from ill-advised financial strategies.

The sobering reality that Ramsey’s conservative philosophy targets is the unpredictability of market trends and consumer behavior, which can turn seemingly smart debt into financial quicksand.

His emphasis on building a cash-based business model is founded on the principle of self-reliance, minimizing risk exposure, and fostering a discipline in financial management that guarantees growth regardless of economic downtimes.

Adhering to a debt-free approach —although it’s a slow process— provides a foundation strong enough to withstand the different changes of business cycles. It is a testament to the adage ‘slow and steady wins the race,’ reinforcing the merit in accruing assets without the shadow of debt looming overhead.

Read: Stop Copying Other People’s Business Models

Reconciling with Grant Cardone’s Vision of Growth

Still, there’s undeniable merit in Grant Cardone’s advocacy for debt as a vehicle for growth. When applied with a laser-focused strategy, a sound understanding of the market, and meticulous planning, leveraging can lead to significant breakthroughs.

However, embracing Grant Cardone’s model demands a high tolerance for risk and a proactive stance on monitoring market trends. It’s crucial for entrepreneurs to recognize that while leverage can amplify gains, it equally magnifies losses.

A disciplined approach requires meticulous risk assessment, ongoing market validation, and a contingency plan for swift pivots.

This model isn’t for the faint of heart. It requires constant vigilance and an agile response to the rapidly shifting sands of market forces. Leverage can serve as a powerful catalyst for attaining remarkable levels of growth and success.

Finding the sweet spot between Ramsey’s conservative approach and Cardone’s aggressive leveraging requires a balanced perspective—considering the potential and pitfalls in equal measure. It’s about adopting a strategic militant approach to borrowing, ensuring there are exact plans for returns on every dime invested.

Final Thoughts

Whether embracing Ramsey’s conservatism or adopting Cardone’s aggressive approach to debt, the guiding principle remains unchanged. Educated and calculated financial decisions tailored to the specific circumstances and capacities of your business lead to success.

For the small business owner, remember that neither philosophy is absolute. It’s the pragmatic blend of caution and courage in your financial strategies that will help you steer your business toward the shore of prosperity.

So, what’s your take—do you side with Ramsey and advocate for debt-free growth, or do you align with Cardone, wielding debt as a crowbar for expansion? Share your thoughts and experiences in the comments below.

Get the latest book by The Real Jason Duncan so you can also learn the tactics to free up over 50% of your time in the business so you can focus on growing it in the way you truly desire, without neglecting your family, friends, or your health.