The Senate Committee on Small Business and Entrepreneurship convened this week to examine the financial health and oversight of the Small Business Administration’s 7(a) Loan Program, a critical funding source for small businesses across the country. Lawmakers, banking leaders, and small business owners debated whether recent Biden-era policy changes have made it easier for underserved entrepreneurs to access capital—or if they have exposed taxpayers to unnecessary risk by weakening underwriting standards.

At the heart of the discussion: Has the SBA gone too far in loosening its lending criteria, or is it finally leveling the playing field for minority-owned and low-income small businesses?

Rising Default Rates & Taxpayer Concerns

Republican lawmakers and community bankers raised alarm over a sharp rise in default rates since the SBA implemented new lending rules in 2023. The most notable changes included:

- The removal of long-standing underwriting safeguards, such as personal financial resource evaluations.

- The reduction or elimination of borrower and lender fees that previously acted as a safety net for the program.

- The expansion of SBA loan access to fintech companies and non-bank lenders, which critics claim are approving loans too quickly without proper borrower vetting.

According to Tim Fitz Gibbon, a senior vice president at First National Bank of Iowa, these shifts have resulted in a doubling of the 12-month default rate and a tripling of early loan defaults. “These changes are putting the program in financial jeopardy,” Fitz Gibbon testified. “For the first time in 12 years, the 7(a) program is operating at a loss. That means taxpayers could be on the hook for bad loans.”

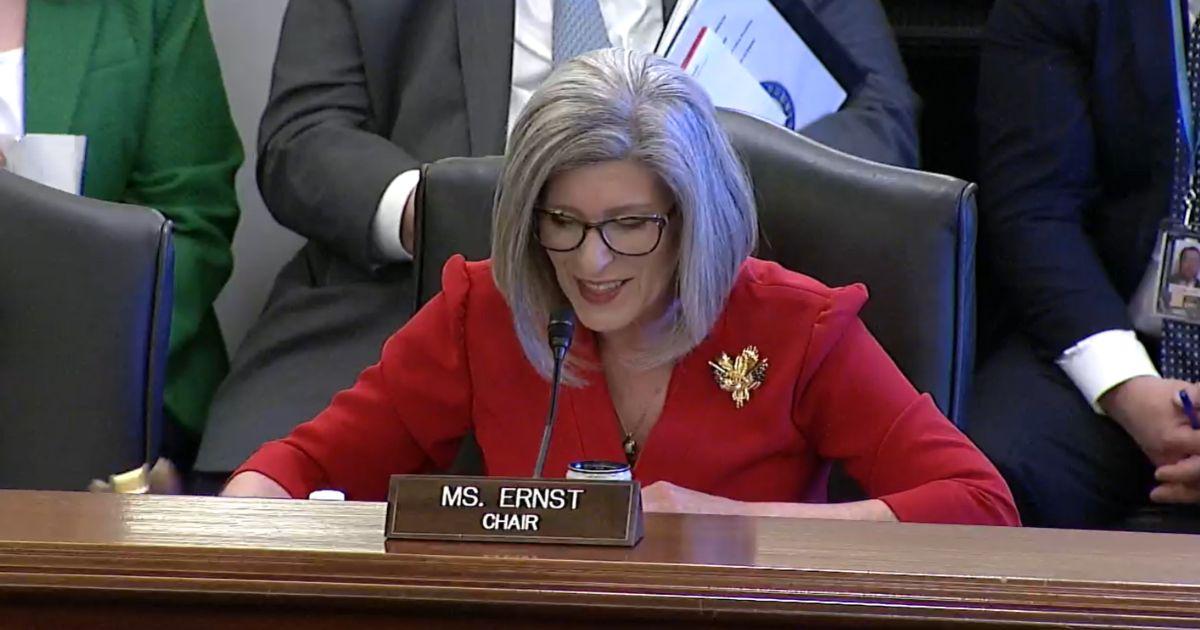

Senator Joni Ernst (R-IA) echoed those concerns. “We are seeing the consequences of these decisions now, with an increase in loan defaults, negative cash flow, and a program that is bleeding money. This is not sustainable.”

But Democrats pushed back, arguing that overall repayment rates remain strong and that the program is fulfilling its mission of providing capital to small business owners who historically lacked access.

A Lifeline for Underserved Entrepreneurs?

For small business owners like Marina Guerrero, the relaxed lending rules have been a game-changer.

Guerrero, a mental health entrepreneur and founder of Colorful Resilience, testified that traditional banks turned her away because she lacked collateral. “I had a strong business plan and a clear market need—but I didn’t have the assets to secure a traditional loan,” she explained.

Through the SBA’s Community Advantage Program, Guerrero received a $250,000 loan from Common Capital, a nonprofit lender specializing in funding for underserved entrepreneurs. With those funds, she built a thriving mental health practice that serves Black, LGBTQ, immigrant, and first-generation communities—groups that often struggle to find culturally competent mental health providers.

“Without this loan, my business wouldn’t exist,” Guerrero said. “And today, we have 15 employees, over 3,000 clients, and are expanding.”

Her story underscores what Senator Ed Markey (D-MA) called the “capitalist magic” of the program. “In 2023 alone, 886,000 jobs were created or retained through 7(a) lending,” Markey noted. “This is proof that the program is working.”

Fintech & Non-Bank Lenders Under Fire

The most contentious issue in the hearing was the role of fintech companies in SBA lending. Traditional bankers argued that fintech lenders—who operate primarily online and use automated approval processes—are flooding the market with high-risk loans that borrowers can’t afford.

Itzel Sims, an SBA lending director at First Security Bank in Arkansas, expressed deep concerns about fintech firms. “Unlike community banks, fintech companies don’t know their borrowers,” Sims argued. “They’re pushing loans at high volume, approving risky borrowers who might not be ready for the debt.”

She pointed to data showing that non-bank lenders have a default rate more than double that of traditional banks.

“We need to reinstate proper underwriting standards and stop allowing fintech lenders to dominate the program,” Sims said.

Senator Cory Booker (D-NJ) acknowledged the risks but cautioned against overcorrecting. “Yes, we need oversight. But let’s not throw the baby out with the bathwater,” Booker said. “For too long, entrepreneurs in communities of color were denied funding altogether. Fintech firms, for all their faults, have opened new doors.”

Proposed Reforms & Next Steps

Several key policy changes were debated as potential solutions to stabilize the 7(a) Loan Program while ensuring access for disadvantaged entrepreneurs:

- Restoring Underwriting Standards – Lawmakers from both parties agreed that some of the removed financial safeguards should be reinstated to prevent excessive defaults.

- Capping Non-Bank Lenders – Some senators suggested freezing or rolling back the expansion of fintech lenders until proper oversight mechanisms are in place.

- Expanding the Community Advantage Program – Many Democrats pushed for making this pilot program permanent and increasing loan limits from $350,000 to $500,000 to better serve growing small businesses.

- Reinstating Borrower & Lender Fees – Reintroducing modest fees could help keep the program self-sustaining, avoiding the need for taxpayer subsidies.

Senator Mazie Hirono (D-HI) voiced strong support for expanding Community Advantage lending, calling it a “lifeline” for rural and minority-owned businesses. “These businesses aren’t just creating jobs—they’re providing essential services to communities that need them most,” she said.

A Bipartisan Path Forward?

“If we don’t act soon, we risk a situation where the 7(a) program collapses under its own weight. That would be a disaster for small businesses and for taxpayers.” – Chair Joni Ernst

Despite sharp disagreements over risk management, the hearing showed that both parties recognize the value of SBA lending.

Chair Joni Ernst concluded with a warning: “If we don’t act soon, we risk a situation where the 7(a) program collapses under its own weight. That would be a disaster for small businesses and for taxpayers.”

At the same time, Senator Markey urged caution against knee-jerk rollbacks. “Let’s not forget: when small businesses thrive, our economy thrives.”

For now, the fate of the SBA’s 7(a) Loan Program remains uncertain, as Congress grapples with how to strike the right balance between financial responsibility and equitable access to capital.

One thing is clear: The decisions made in the coming months will shape the future of small business lending in America.

Key Red Flags in Predatory Fintech Lending

If you’re evaluating a fintech lender, watch out for these warning signs:

- High Effective Interest Rates – If a lender doesn’t clearly state APR, it’s a red flag.

- Daily/Weekly Payments – Can strangle cash flow for small businesses.

- Hidden Fees – Some lenders add origination fees, maintenance fees, or prepayment penalties.

- Misleading Marketing – Loans advertised as “low interest” but have sky-high total repayment costs.

- Lack of Transparency – If the lender won’t give you full loan terms upfront, be cautious.

Related articles:

How To Fund Your Business In A Tough Market(Opens in a new browser tab)

How To Prepare for Rougher Small Business Banking(Opens in a new browser tab)