Yes, the Department of Government Efficiency is about politics. As President Obama said, “elections have consequences”. President Trump, as promised, has established DOGE to find and root out government waste and efficiency. We all want the government to not waste and to be efficient. Of course, politics comes into play and the Democrats have their version of this and the Republican have their version of it.

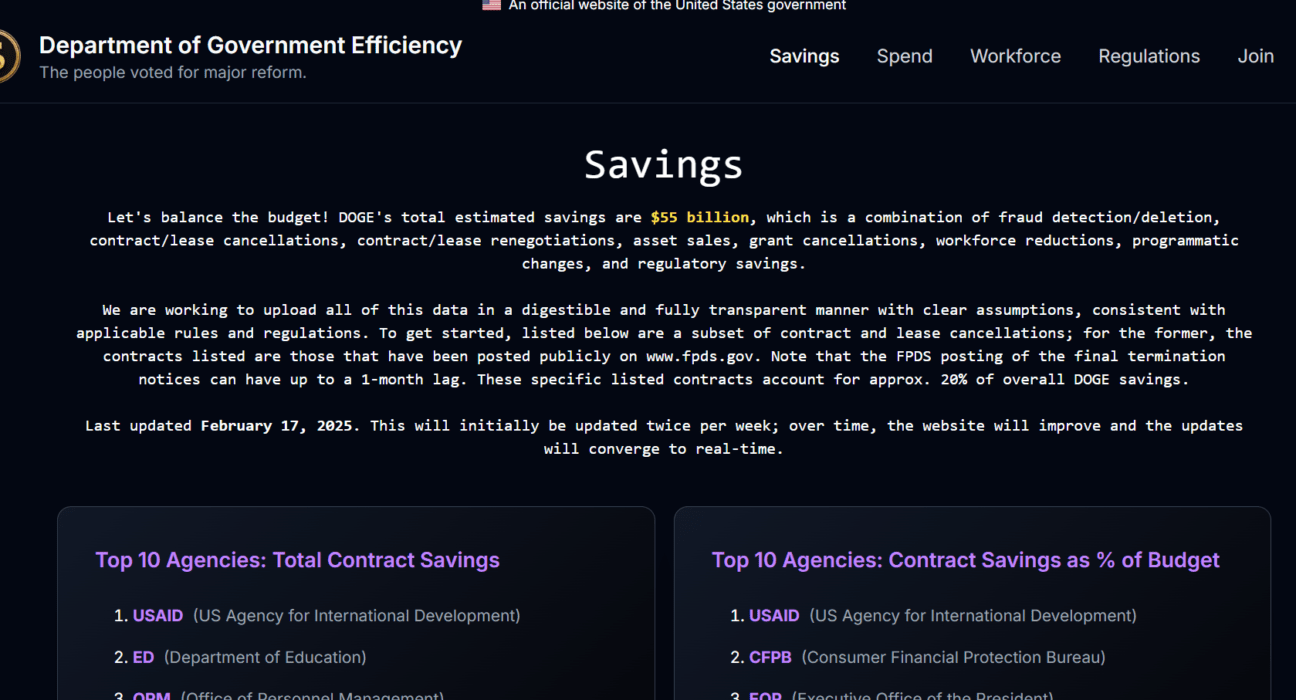

But there’s a lesson in all of this for us small business owners. The NY Times wrote that indeed DOGE has saved billions of dollars for the government but probably not $55 billion (as of 23 Feb 2025) that DOGE claims it has. Calculating the savings and keeping track of what’s already ended, what was not spent and etc is not easy.

For small business owners we MUST do better for the sake of running successful business.

We can use tools like Intuit QuickBooks, Zoho Books, FreshBooks, Xero, Wave Accounting and more to have accurate business records.

Keep A Close Eye and Accurate Records

Running a small business is an adventure—a thrilling blend of creativity, hard work, and a passion to serve customers with products or services they need. Yet behind the scenes of every successful venture lies one critical ingredient: a clear, honest picture of your financial landscape. Whether you’re a boutique baker, a neighborhood bookstore owner, or a freelance graphic designer, keeping a close eye on your cash flow, income, expenses, and more is essential for long-term success.

Imagine setting out on a road trip without a map. You might get lucky, but odds are you’ll find yourself off course, facing unexpected detours and even dead ends. Your business finances work much the same way. Business isn’t just about creating a product or service and selling it—it’s about doing so profitably. Every sale, every invoice, and every bill paid contributes to a bigger picture that tells you whether you’re truly on the path to success or veering off into financial trouble.

The Heartbeat of Your Business: Cash Flow

Cash flow is like the pulse of your business. It measures the money coming in versus the money going out. When you understand your cash flow, you’re able to anticipate lean periods, make informed decisions about growth, and avoid the pitfalls of running out of cash unexpectedly. By monitoring your cash flow regularly, you ensure that your business remains agile—ready to seize new opportunities while also weathering any economic storms that might come your way.

Know Your Numbers: Income and Expenses

A healthy business requires a keen awareness of both sides of the financial ledger. On one side, you have your income—money earned from sales that fuels your growth and rewards your hard work. On the other, there are expenses: rent, utilities, salaries, cost of goods sold, and the myriad of overheads that keep your business running. Each expense, no matter how small, plays a role in your overall financial health. When you track these meticulously, you can identify where you’re spending too much, find ways to cut unnecessary costs, and ultimately, boost your profit margins.

The Balance Sheet: Your Financial Report Card

Think of your balance sheet as a snapshot of your business’s financial health at any given moment. It’s more than just a pile of numbers—it’s a comprehensive report card that details your assets, liabilities, and equity. Regularly reviewing your balance sheet helps you understand your business’s strengths and weaknesses. Are you over-leveraged? Do you have enough assets to cover your debts? These are the questions that, when answered, provide a roadmap for financial stability and growth.

A Real-World Narrative

Consider the story of Sarah, who opened a small café in her hometown. At first, Sarah was focused solely on perfecting her recipes and delighting her customers. Sales were good, but something was amiss. Despite a loyal clientele, Sarah’s business started to struggle during slower months. The turning point came when she began tracking her cash flow meticulously. By keeping a close eye on her daily income and expenses, Sarah discovered that her overhead costs were eating away at her profits more than she realized. With this insight, she negotiated better rates with suppliers and streamlined her operations. Today, Sarah’s café is not only a local favorite, but it’s also a model of financial discipline—a reminder that knowing your numbers is just as important as having a great product.

The Bottom Line

For small business owners, the journey to success is paved with careful planning and constant vigilance over your finances. It’s not enough to create something wonderful; you must also ensure that the numbers behind your dream tell a story of profit and growth. By keeping track of your cash flow, income, and expenses—and by regularly reviewing your balance sheet—you empower yourself with the knowledge to steer your business confidently through every twist and turn.

Remember, a thriving business isn’t built solely on passion and creativity. It’s built on the solid foundation of financial awareness, strategic planning, and the discipline to monitor and adapt to your ever-changing financial landscape. Embrace these practices, and you’ll be well on your way to transforming your small business into a lasting success story.